Pursue Your Studies

in Canada

Your Bank, Your Way

If you intend to study in Canada as an international student, you must meet the eligibility requirements as defined by IRCC under their Study Permit Program.

One of these requirements for international students is to have a proof of financial support that substantiates that they can support themselves and the family members who come with them while they are in Canada.

In addition to the cost of tution fees, an International student mush show at least one of the proof of financial support to apply for a study permit to Canada.

One way to meet this requirement is to purchase a Guranteed Investment Certificate (GIC) from a participating Canadian financial institution such as SBI Canada Bank.

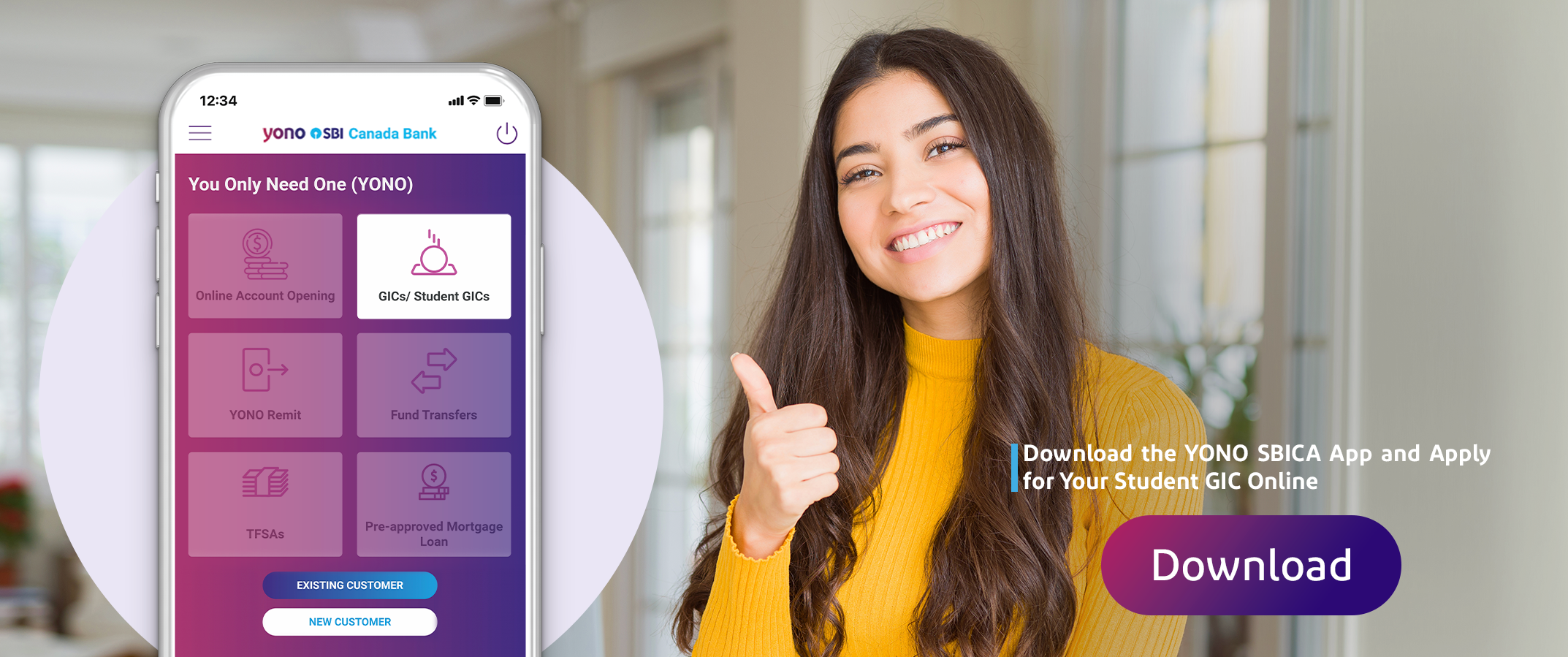

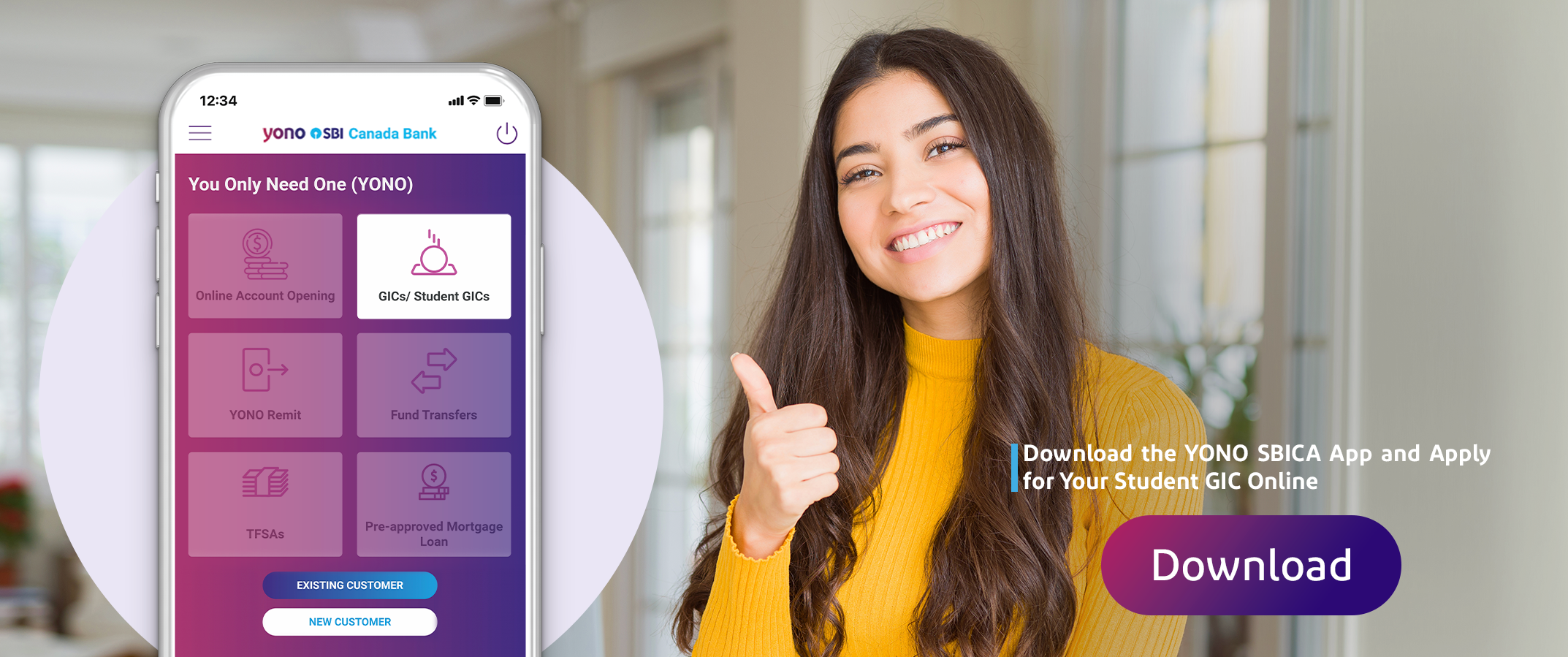

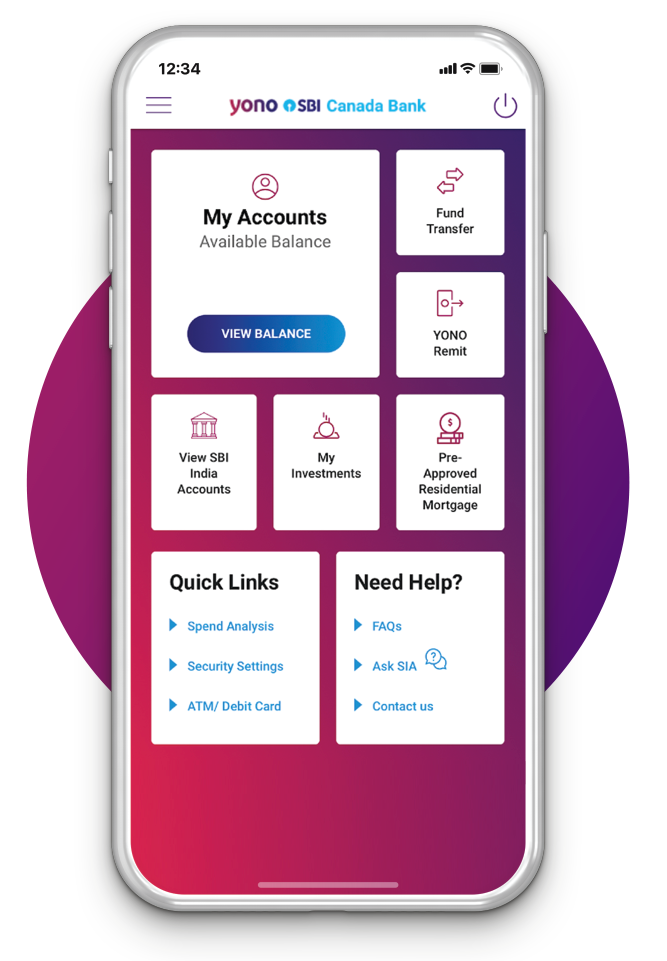

Download the YONO SBICA

and apply for Student GIC

Get your Wire

Transfer Details

Transfer $20,635

CAD + the Fee *

Arrive In Canada &

Activate your account

Access to your funds

1

A Chequing or a Saving Account

Upon activation, your account will be

credited with CAD 4,135

2

A Non-Redeemable Student GIC Account We will invest the remaining CAD 16,500 in a Non-Redeemable and Non-Renewable GIC for one year with monthly payments of principal, (i.e. CAD 1,375 + Monthly Accrued Interest) to

your chequing / savings account

* SBI Canada bank charges administration fees of CAD 150 only. Please note that this fee is non-refundable.

Why Choose

SBI Canada Bank?

Instant Processing

Our program offers fast processing of your GIC application, ensuring that you can get started with your studies in Canada without any delay.

Best Interest Rates

You'll earn the best interest rates on your GIC investment with us, which means your money will work harder for you while you focus on your education.

Best CAD to INR

Exchange Rate

We provide the best exchange rate for converting your Canadian Dollars (CAD) to Indian rupees (INR), so you can make the most when you send money back home.

One Debit Card

With our program, you'll receive one debit card that can be used both in Canada and India, making it easier for you to manage your finances across both countries.

Apply for Your Student

GIC with the YONO SBICA

Mobile Banking App

The YONO SBICA mobile banking app provides an online banking experience allowing you to manage your account 24/7, no matter where you are.

Frequently Asked Questions

A GIC is an investment account that offers a guaranteed interest rate over a fixed term. You must leave your funds in the GIC for a specified period of time before you are allowed to withdraw the money. During that time, your money will earn a guaranteed interest rate.

Safety of your Deposit

SBI Canada Bank is a member of CDIC. Student GIC is eligible for deposit insurance from the Canada Deposit Insurance Corporation (CDIC), subject always to maximum coverage limitations as outlined in their brochure "Protecting Your Deposits" and provided it is payable in Canada. To find out information about deposit insurance from the Canada Deposit Insurance Corporation including what instruments and/or products are eligible for deposit insurance, visit their website www.cdic.ca. Information on deposit insurance is also available in the CDIC brochure entitled "Protecting Your Deposits".

How does the Student GIC Program work?

After setting up an account with SBI Canada Bank, you transfer CAD 20,635 plus fees to purchase the GIC. After successful verification and account activation, the bank will then open two accounts in your name:

- A Chequing Account or a Saving account: We will credit CAD 4,135 to this account.

- A Non-Redeemable Student GIC account: We will invest the remaining CAD 16,500 in a non-redeemable and non-renewable GIC account for a one-year term.

The money in your Non-Redeemable GIC account will earn interest. Each month for 12 months, a monthly instalment of principal i.e., CAD 1,375 + Monthly Accrued Interest will be paid from your Non-Redeemable GIC account into your savings or chequing account.

How much does it cost?

SBI Canada Bank charges an administration fee of CAD 150. Please note that this fee is non-refundable. SBI Canada Bank must receive CAD 20,785 in full without any deductions to process your GIC request and collect the required administrative fees. Please note that your bank may charge you a fee to transfer the funds from the originating account to the SBI Canada Bank account. This fee is not refundable.

SBI Canada Bank offers two online channels for you to apply for your Student GIC:

Download YONO SBICA Mobile Application

- Select "New Customer" followed by "Open Student GIC" and start your application.

- Enter your email id and mobile number and validate via One Time Password (OTP).

- Carefully read the instructions, enter your details, and upload your passport copy.

- Read and check the Terms & Conditions. Review and submit your application.

- Congratulations!! Your application is done. Please note your Unique customer ID

- Download and save your Student GIC Wire Payment instructions to send money to your SGIC Investment account.

- Set your Login Password and Mobile PIN.

Watch the Video to apply

through YONO SBICA Mobile

application

Online web application - Student GIC Portal

In case you do not have access to a mobile device, you can also choose to apply through our web application – Student GIC Portal

- Click here to Register and create your username and password.

- Click on "My Application" and start entering your details.

(Follow the instructions and provide the required information) - Upload copy of your passport identification page(s)

(Must include your photograph, signature, and address) - Submit your application.

- We will review your application and send your SBIC Student GIC Investment account Number along with the wire payment instructions.

Please note that our primary way of communicating with you is through the portal. You should log in to the portal regularly to check for messages. Please see the application guide for details.

- Once you have your Student GIC investment account number and wire transfer details, you are ready to transfer CAD 20,635 (twenty thousand six hundred thirty-five Canadian dollars), excluding fees, to purchase your GIC through SBI Canada Bank and meet Immigration Canada's financial requirements for a student visa. Your bank can help you with the wire transfer. Please note that your bank, including the State Bank of India, may also charge you a fee. You are responsible for paying these fees.

- SBI Canada Bank charges an administrative fee of CAD150. Please note that this fee is non-refundable.

- SBI Canada Bank must receive CAD 20,785 in full without any deductions to process your GIC request and collect the required administrative fees.

- If SBI Canada Bank receives less than the required amount, the funds will be returned to your bank account at the same bank where the original wire transfer was initiated and your GIC request will not be processed.

- If your money is returned, you are responsible for paying any money transfer fees and all of the intermediary bank or correspondent bank charges as a result of the decline.

- Please note that funds remitted through service providers such as money exchange houses, money transfer services, money services businesses or any third-party services (such as parents, relatives, or friends) will not be accepted.

- The wire transfer must be from a bank account in your country of residence that is exclusively in your own name or jointly held with your parent(s) / spouse.

- Please note that funds will be accepted only if the name of the sender and the beneficiary (i.e., the recipient) matches. Your bank must ensure that the wire transfer/MT103 should include the remitter/student's name, account number and full address at Line 50 and the beneficiary/student's name, account number and full address at Line 59. If the applicant/student doesn't have a specific address in Canada, the student's full address in the home country shall be provided in Line 59.

- In case of any mismatch, the wire transfer will not be accepted. The funds will be returned to your bank account at the same bank where the original wire transfer was initiated and your GIC request will not be processed at your own risk and responsibility.

- Please note that international wire transfers take about five business days. It is up to you to allow adequate time for the funds to transfer, keeping in mind the time zone difference between your country and Canada and weekends or holidays in both countries.

- Approximately in 01 business day after receiving the required funds, SBI Canada Bank will issue an Investment Declaration Advice that can be downloaded.

- By logging onto your mobile application (if you have applied through YONO SBICA app)

- Or from the web application by using your credentials (if you applied on the online application)

- The Investment Declaration Advice will include the interest rate on the issue date for a one-year Student Investment Account. Our current Student Investment Account interest rates are shown on our Interest Rates Interest Rates page. All interest rates are subject to change from time to time.

- Please print a copy of the Investment Declaration Advice and keep it for your records. You will need to submit a copy of this letter when you are applying for your study permit.

After you arrive in Canada, you will need to confirm your identity using our Online KYC Method (YONO SBICA), SBI Canada Bank branch or Canada Post location to activate your account and access your funds. You must do this within 180 days of arriving in Canada.

Through Your Mobile

- Log in to your YONO SBICA app and click Activate Account in the My Accounts section.

- Carefully read the instructions and select your account type.

- Add your Social Insurance number and Canadian Study permit details.

- Add your Canadian Address and choose Online KYC

- Review Online KYC Terms & Conditions and select your id document and click picture of the document.

- Complete the verification process by taking a selfie video.

- Click for debit card and review Account Terms & Conditions and submit.

- In “My Accounts” section of the application, you will be able to view both your accounts.

Watch the Video to activate

through YONO SBICA Mobile

application

Please note that this feature is only applicable for students who have applied for Student GIC using YONO SBICA Mobile application.

By Visiting a Canada Post location

If you can't visit an SBI Canada Bank branch, you can also verify your credentials at a Canada Post location. To verify your credentials at a Canada Post location, please follow the instructions as under:

- Access your Student GIC portal > Go to "My Application" tab and select "Activate My Account" menu, complete the"Activate My Account"application.

- Create and print/save the Canada Post ID Verification Instruction Document.

- Finally at the same menu of Student GIC Portal view/print your Student GIC account statement.

- When visiting Canada Post location present the following documents to the staff to verify your identity:

- Original passport.

- DSS number and unique 2D barcode.

- Student GIC statement that shows your Canadian mailing address.

Canada Post will allow 3 attempts to verify the identity. Failing to do so would require you to visit the SBI Canada branch in person.

By Visiting SBIC Branch

Visit your closest SBI Canada Bank branch to open a personal account and activate the GIC by providing the following documents:

- Your original passport.

- Your original study permit (i.e., IMM 1442) issued by the Canadian High Commission.

- Original letter of enrollment issued OR Student ID card issued by your Canadian educational institution.

- Printout of the Investment Declaration Advice issued by SBIC.

There may be circumstances when you no longer require your student GIC investment and you are eligible to request a refund of your CAD 20,635 investment. These include:

- The Canadian High Commission declined your application for a study permit. In this case you must submit the following documents along with your signed refund application:

- Self-attested copy of the Refusal letter issued by the Canadian visa office in your country.

- The Canadian educational institution, you applied to, declined your admission. In this case you must submit the following documents along with your signed refund application:

- Self attested copy of the Refusal letter or Email sent to you by the educational institution confirming the refusal of admission.

- The Canadian educational institution approved your admission and you have obtained Study Visa, but you have decided not to pursue your studies and have withdrawn before arriving in Canada.

- Clear Copy of Visa Approval Letter issued by IRCC.

- Confirmation from the educational institution on withdrawal of your admission, and / or

- Confirmation from educational institution on the refund of your academic fees.

- After making your Student GIC investment, you decided not to apply for a Canadian study permit.

- Confirmation from the educational institution on withdrawal of your admission,

- Confirmation from educational institution on the refund of your academic fees, and / or

- SBI Canada Bank will contact the Canadian visa office to confirm that your visa application was not filed.

- After arriving in Canada, you withdrew your enrolment from the educational institution and are now pursuing your education in a country other than Canada.

- In this case, you must provide SBI Canada Bank with:

- Proof that you have returned to your country, such as a self-attested copy of the passport page showing the entry date stamped by the immigration authorities at the airport as proof of your return.

- Confirmation from the educational institution on your withdrawal of your admission, and / or

- Confirmation from educational institution on the refund of your academic fees.

- In this case, you must provide SBI Canada Bank with:

Please note that irrespective of your moving to a country other than Canada, the refund will only be issue to your account from where SBI Canada Bank received the funds at the time of creating the Student GIC.

How to claim your refund

- Login to the Student GIC Portal . You will need to use your existing username and password that you used while applying for your Student GIC.

- Complete and print your refund application form.

- You will need to take a print and sign your refund application and upload the scanned copy of the refund application along with the required document(s) mentioned above (as applicable).

- Your refund application must contain all the required documents/information to be processed. If your refund application is incomplete, we will return it to you with an explanation to help you correct the mistake and provide the missing information or documents.

- You must revise and re-submit the application after making the necessary correction(s) and attaching all the required documents.

- SBI Canada Bank might contact the Canadian High Commission in your country to confirm your application status (for example, the refusal or the cancellation status of the study permit). The refund process will be strictly subject of receiving this confirmation from the Canadian authorities.

- It may take up to four weeks to process your refund request.

- Once your request has been approved by the Canadian High Commission, SBI Canada Bank will cancel your investment. SBI Canada Bank will redeem the outstanding balance from your SBIC Student GIC Investment Account, along with accumulated interest (if any), and wire the funds to the same bank account and the same bank from which the wire transfer initially originated.

- The original administrative fee of CAD150 is not refundable.

- SBI Canada Bank will deduct a money transfer fee of CAD25 from the eligible refund amount.

- Please note that additional fees may be charged by intermediary banks or correspondent banks during the wire transfer of the refund. You are responsible for paying any additional fees as charged by the intermediaries' correspondents during the refund process.

- SBI Canada Bank will notify you on your registered email confirming the transfer of funds and the closure of the accounts.