Banking on the Go!

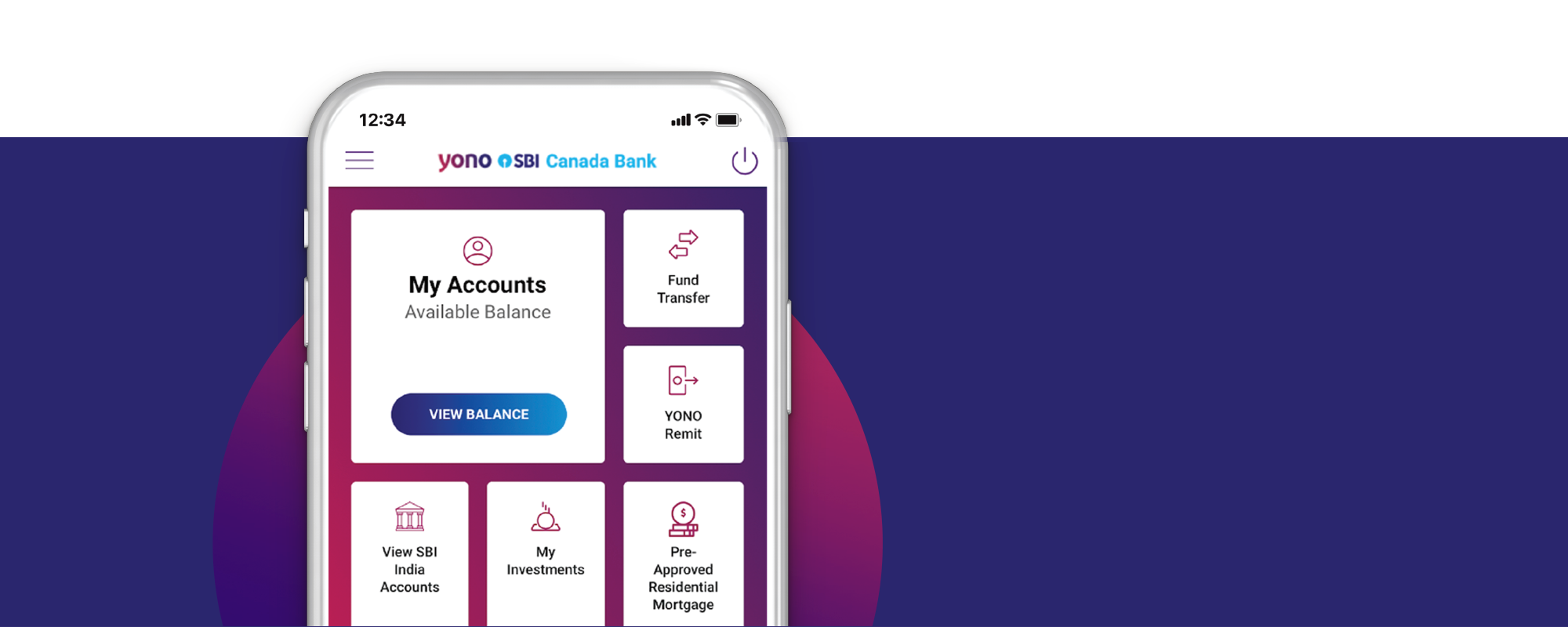

With the YONO SBICA mobile banking app, you can be rest assured that your banking is in safe hands—Yours!

Our online banking experience allows you to view and manage your accounts 24/7 no matter where you are.

Open a New Account

Open an account of your choice, right from your phone.

Save and grow your investments

Open a new GIC (Non-Registered / Registered) and grow your savings.

Send Money to your Loved ones

In a few Clicks, send money to India at the best rates and at zero fees

Smart.

Intuitive.

Convenient.

All Your Daily Banking

![]() Open a new account

Open a new account

![]() Open a Student GIC

Open a Student GIC

![]() Open a GIC or TFSA account

Open a GIC or TFSA account

![]() Remit money to India

Remit money to India

![]() View your account balance with SBI India

View your account balance with SBI India

![]() Check your balances and transaction history

Check your balances and transaction history

It’s never been quicker or easier to open a new account by using the YONO SBICA app.

- Download YONO SBICA App from the app store

- Click on "New Customer"

- Select and account of your choice (Super Saver, Savings, Chequing account)

- Enter personal details (name, address, Social Insurance Number, employment status etc.)

- Select a suitable KYC verification method (Online KYC, Canada Post, SBI Canada Bank branch)

- Activate your account and fund it through Online Banking or Interac e-Transfer®

Make your money work for you. Earn more with our GICs

To Open a GIC account

- Download YONO SBICA App from the app store

- Click on "New Customer"

- Select "Open GIC"

- Select the preferred type "Redeemable GIC / Non-Redeemable GIC"

- Select Investment Option (Enter Amount,Select preferred term of GIC"

- Set-up Maturity Instructions

- Select a suitable KYC verification method (Online KYC,Canada Post, SBI Canada Bank Branch)

- Activate the account and fund it through Interac money transfer on Internet Banking

A tax-free savings account from SBI means you’ll be saving money all year round.

To Open a TFSA - Power Savings Account

- Download YONO SBICA App from the app store

- Click on "New Customer"

- Select preferred Account Type (TFSA Power Savings)

- Select if you require TFSA Transfer In – If "YES" – Provide TFSA Issuer details (Institution Name, Address, Transit number, Institution code)

- Provide personal details (name, address, Social Insurance Number, employment status ,etc.)

- Select the KYC verification method (Online KYC, Canada Post, SBI Canada Bank Branch)

To Open a TFSA Power GIC

- Select Investment Option (Enter Amount, Select the preferred term of GIC)

- Set-up Maturity Instructions

- Provide personal details (name, address, Social Insurance Number, employment status , etc.)

- Select the KYC verification method (Online KYC , Canada Post, SBI Canada Branch)

- Activate the account and fund it through Interac e-Transfer® OR Internet Banking

- Click on "New Customer"

- Select "Student GIC"

- Provide personal details (name, address, Social Insurance Number, employment status ,etc.)

- Enter Passport details along with Canadian Institution details and upload front and back image of the passport

- Select a suitable KYC verification method (Online KYC, Canada Post, SBI Canada Bank Branch)

- Download Wire transfer details and fund the account

- Download the Student GIC certificate

- Open a Savings or Chequing account upon activation

Once you have arrived in Canada, you have the option of activating your Student GIC account

- Online through YONO SBICA Mobile application. Watch the Video to learn more

- Visiting nearest Canada Post Location

Please note :

*Online KYC activation and Canada Post method would only be available to you

if you applied for your Student GIC through YONO SBICA mobile app.

* If you opened your SGIC account online, please click here for activating your account - Visiting nearest SBI Canada Bank Branch

Please keep the following documents ready for a seamless experience :

- Your passport along with a Valid Study Permit

- You should have a valid Social Insurance Number (SIN)

- Landing Document,

- Investment Advice (GIC) with SBI Canada Bank

- Enrolment number issued by your designated learning institution

Take advantage of your account with SBI Canada Bank and send money to India

- Best CAD/INR Exchange rates

- Zero fees

- Instant Credit*

If you have an account with SBI Canada Bank and you are registered for mobile banking :

- Open the YONO SBICA app on your mobile device

- Click "YONO Remit" on the home screen

- Choose the beneficiary

- Choose account, add funds, review and submit

Watch the video to learn more

* Instant Credit to your SBI Account in India. Terms & Conditions may apply

Ease of Banking

For all your needs, we have got you covered

Customer Service

Get all the support and information you need

One app - endless possibilities

Send money, Deposit cheques, Pay bills and more with YONO SBICA mobile banking app